Last Week:

- U.S. equities finished mixed for the week: The Dow Jones Industrial Average (DJIA) closed 64 points lower, or fell 0.27%, to 23,358. The Standard & Poor’s 500 (S&P 500) index lost 3 points, or fell 0.13%, to 2,579. The Nasdaq closed last week 0.47% higher at 6,783. The S&P has now gone 62 weeks without more than a 2% decline, marking the longest streak since 1965.

- House passes tax bill: Republican backed tax-cut legislation passed in the House of Representatives, 227-205 last week. The House bill would cut the corporate tax rate from 35% to 20%, resulting in an estimated $1.4 trillion deficit over 10 years. The Senate is expected to tackle its own tax bill later this week. Analysts expect a more challenging road to victory for the Senate bill, which includes a repeal of the Affordable Care Act’s individual mandate.

- Peltz wins P&G proxy vote: After appearing to have narrowly lost the Procter & Gamble proxy vote, an official re-count found Nelson Peltz of Trian Fund Management actually won the vote to join the P&G board by a slim margin.

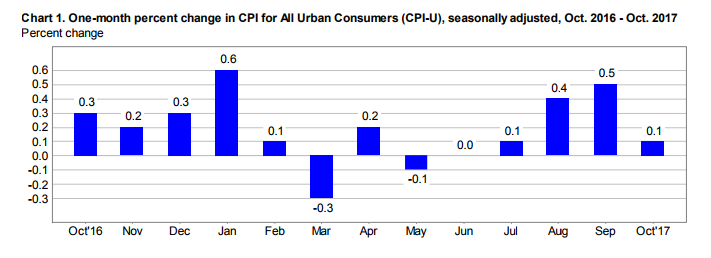

- U.S. Consumer Price Index (CPI): Last week, the Bureau of Labor Statistics reported U.S. CPI increased 0.1% during the month of October, and 2.0% over the last 12 months. Core CPI (Index for all items less food and energy) increased 0.2% in October and 1.8% over the past 12 months. The boost to gas prices from hurricane-related disruptions in the last period were unwound, but analysts posit rising rents and healthcare costs could lead to a gradual buildup of underlying inflation.

Source: Bureau of Labor Statistics (November 2017)

Look Ahead:

- Key reports/items for the upcoming week include, Flash PMI from the Eurozone, Germany and U.S. (Nov), U.S. Leading Indicators (Oct), Federal Open Market Committee meeting minutes (Wed), and University of Michigan Consumer Confidence (Nov).