Happy Thanksgiving! The gateway to the most wonderful time of the year.

The historical marker at 922 Spruce Street in Philadelphia states:

Sarah Josepha Hale (1788-1879) One of America’s first woman editors, Hale greatly increased subscriptions to Godey’s Lady’s Book in her four decades as editor. She successfully promoted a national Thanksgiving Day to Presidential Lincoln. The author and women’s rights advocate lived here.

The author of Mary had a Little Lamb wrote to five Presidents in a bid to codify a national day of thanksgiving. Her efforts resulted in President Lincoln establishing Thanksgiving as the third nationally recognized holiday after Washington’s Birthday and Independence Day.

We can be thankful for many things in 2019, particularly as investors. There is the obvious: the S&P 500 is up 26% year-to-date. There are also less obvious events worth highlighting:

Early this year, the Federal Open Market Committee (FOMC) reversed course from their 25 basis point hike in December of last year. Since then, the FOMC actively lowered rates in an effort to right the yield curve. We may look back on these actions as obvious, but there have been other times in history when the Fed did not react so quickly. We are glad they did.

There have been several “broken” IPOs this year. Out of the ten high-profile initial stock offerings this year, only three are trading above their opening day price. Companies such as Uber and Lyft are trading more than 30% below their first trade. WeWork never even made it to market, as investors balked at its business model. The market’s lack of appetite for multi-billion-dollar unicorns that can’t turn a profit, or in the case of WeWork, have incremental losses greater than incremental revenue, is evidence to us of a lack of investor’s irrational exuberance. This valuation discernment is evidence this market is not overstretched.

Other evidence of a lack of investor exuberance is the increase in money market reserves, up 22% year-over-year. Net redemptions from equity funds continues. The incremental buyer of stock continues to be corporations. We are thankful for these stock buybacks. While we would be more excited if companies were growing through increased capital expenditure programs, we realize that most management teams are rational in their capital allocation plans. Corporations, flush with cash have made the decision they have spent all they need to support their growth plans, and hence returning the remaining cash to shareholders.

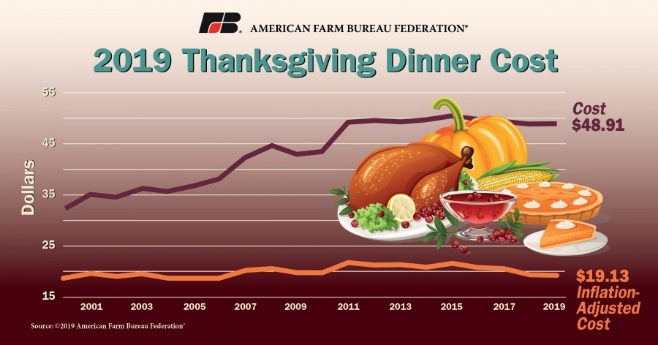

Inflation has also remained benign. We think back eight years to the dire predictions of runaway inflation following the financial crisis and we are thankful the doomsayers were proven wrong. The American Farm Bureau recently published that the average cost of a Thanksgiving feast for 10 costs less than $5 per person and slightly less than last year.

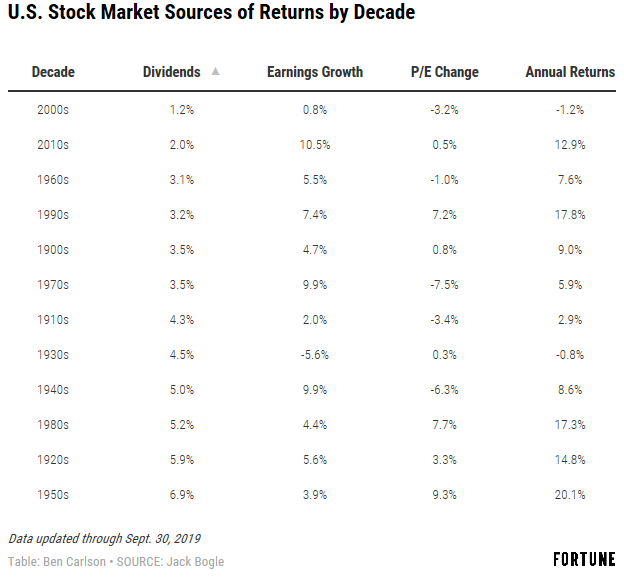

We are also thankful for a decade of earnings growth. Most investors believe that the past decade’s market advances were fueled by an expansion in valuations. Writing in Fortune1, Ben Carlson points out that “shockingly, a vast majority of the gains over the past decade can be explained almost exclusively by improving fundamentals. Earnings growth and dividends explain nearly 97% of the annual returns for the 2010s. So the change in valuations have played a minor role in explaining the gains during this cycle.” While something to be thankful for, we are also realistic in pointing out that earnings were at insanely low levels coming out of the Great Recession. We share Carlson’s sentiment that, “dividend yields are lower now than they were in the past while earnings growth cannot stay elevated forever. So expected returns should be lower over the next decade. But the change in P/E ratio is really a gauge of investor sentiment and no one can predict what that will be today, tomorrow, or 10 years from now.”

THE WEEK AHEAD

As we enter the holiday-shortened week, the focus will be on corporate actions with a number of macroeconomic data points as well. On the corporate side, we will see a number of companies report quarterly earnings, including Hewlett Packard, Best Buy, and Dollar Tree as earnings season continues to wrap up. On the economic front, we will see housing numbers and consumer confidence on Tuesday and third quarter Gross Domestic Product, Durable Goods and Personal Income data on Wednesday. On Thursday, markets will be closed, with a shortened trading day on Friday. ”