Last Week:

- U.S. equities finished negative for the week: In the holiday-shortened week, we saw tech stocks lead the decline to start the week with all the FAANG stocks (Facebook, Apple, Amazon, Netflix, and Alphabet) hitting bear-market territory, erasing the S&P500’s gains for the year. On the week, the Dow Jones Industrial Average (Dow) lost 1,127 points, or fell 4.44%, to 24,286. The Standard & Poor’s (S&P500) index decreased 104 points, to 2,633. The Nasdaq closed 4.26% lower at 6,939 while the 10-year Treasury ended the week at 3.05%.

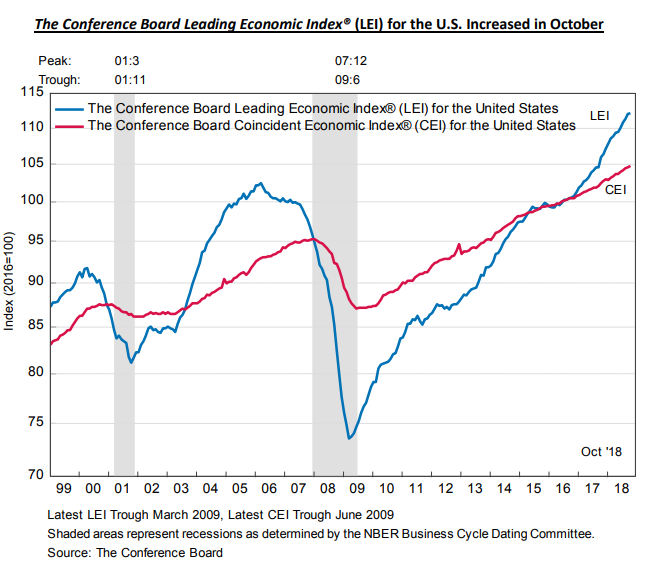

- U.S. Leading Economic Indicators (LEI): The Conference Board’s Leading Economic Indicators Index for the U.S. rose 0.1% during the month of October, following the 0.6% increase in September and August’s 0.5% increase. Although the September numbers appear modest relative to the strong numbers we’ve seen this year, they are consistent with the narrative of a strong U.S. economy at this stage of a maturing business cycle. According to the Conference Board, “The index still points to robust economic growth in early 2019, but the rapid pace of growth may already have peaked. While near term economic growth should remain strong, longer-term growth is likely to moderate to about 2.5 percent by mid to late 2019.” The Board’s Coincident Economic Index (CEI), a measure of current economic activity, increased 0.2%, with the Lagging Economic Index also increasing 0.4% during the month.

Look Ahead:

- Third quarter earnings season will continue to wrap up this week, with expected data releases surrounding retailers as Black Friday and Cyber Monday sales remain in focus. Some notable reporters include Salesforce, J.M. Smucker, Tiffany & Co., Dollar Tree, TD Bank, and HP Inc., among others. There will also be a number of sell-side conferences and investor days during the week.

- On the economic calendar, we will see Dallas and Chicago Fed numbers on Monday, S&P Case-Shiller Home Price index and Consumer Confidence data on Tuesday, and Gross Domestic Product (GDP) on Wednesday. Personal Income data and Fed meeting minutes will be available Thursday and the Chicago Purchasing Managers’ Index (PMIs) numbers will be out on Friday. Outside the U.S., we will see Import prices in Germany and Industrial profits in China to start the week, followed by M3 money supply and loan growth data out of the Euro-zone mid-week. The week will close with Euro-zone confidence, inflation data, and Manufacturing PMI numbers from China.

- On Wednesday, Fed Chair Jerome Powell will speak the Economic Club of New York.