The Markets Hit a New High on Friday Following the October “Blowout” Jobs Report

President Trump has a penchant for excessively flamboyant descriptors, but he was outdone by Wall Street firm Evercore ISI, who called Friday’s jobs report “Perfect.” Nonfarm payrolls rose 128,000, much higher than the 85,000 gain the average economist estimated. Almost as important, the last two months of jobs gains were revised up by 94,000. Payroll growth averaged 176,000 for the past three months, which is enough to keep the unemployment rate down despite more entrants into the workforce. In fact, labor participation rose to 63.3% last month. This could be the best number of this perfect report, since rising participation may allow the economy to continue to grow without spurring inflation or wage pressures.

Little inflation pressure means the Fed can remain dovish. According to Federal Reserve Chair Jerome Powell, he will need to see a “really significant” rise in inflation before supporting a return to interest rate hikes. Chairman Powell also used Fed speak to indicate that the Open Market Committee expects to now pause after three sequential rate cuts. “We see the current stance of monetary policy as likely to remain appropriate as long as incoming information about the state of the economy remains broadly consistent with our outlook,” he said at last week’s press conference.

Three cuts and a pause could be the exact elixir the stock market needs to reach new heights, according to Strategas Research Partners. History shows us that three cuts and a pause is usually indicative of a successful mid-cycle adjustment and economic soft-landing. “If this is truly a “mid-cycle” adjustment, the stock market should take off (+14%) within the next couple of months, otherwise, a recession or the end of the cycle becomes more likely, writes Strategas’ Jason Trennert.

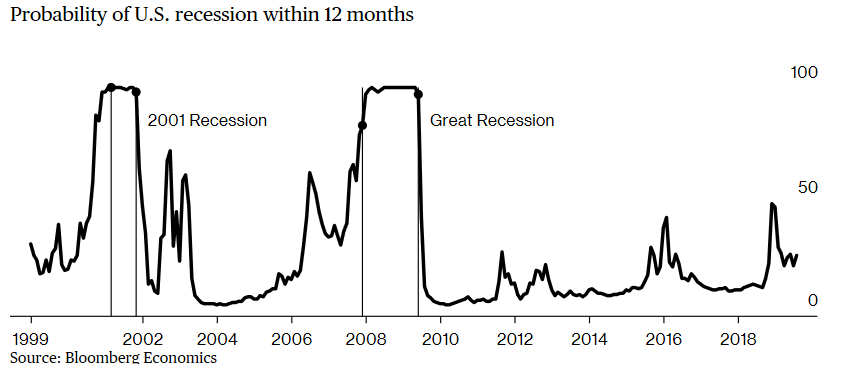

It is amazing to us how quickly investment sentiment swings, it was just over a month ago that investors were finding concern in almost everything. Now, investors are seeing the glass half-full. Even Bloomberg points out that their recession indicator estimates the chance of a U.S. recession at some point in the next year is 27%. That is higher than it was a year ago but lower than before the last recession.

As we look to what the month ahead holds, we expect to close out a better-than-expected earnings season and the signing of a Phase I trade deal with China. We also hope that Nancy Pelosi’s recent positive comments regarding the passage of the U.S.-Mexico-Canada (USMCA) trade deal are well founded. At Haverford, we still assume a lessening in global trade tensions will be positive for economic growth and markets.