Last Week:

- U.S. equities finished negative for the week: The stock market went for a wild ride this week, ending down approximately 6.7% off all-time highs. The chief culprits of the market’s decline were concerns around interest rates, trade wars, and corporate earnings expectations. During the week, the Dow Jones Industrial Average (Dow) lost 1,107 points, or fell 4.19%, to 25,340. The Standard & Poor’s (S&P500) index decreased 118 points, to 2,767. The Nasdaq closed 3.74% lower at 7,497, while the 10-year Treasury ended the week at 3.15%.

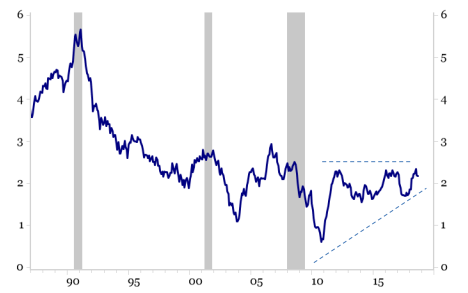

- U.S. Economic Data: Last week, The Bureau of Labor Statistics reported U.S. inflation as measured by the Consumer Price Index (CPI) increased +0.1% in September and +2.3% year over year, moderating from the +2.7% annualized number we saw last month. The shelter index continued to rise and accounted for more than half of the seasonally adjusted increase we saw during the month. Core CPI (CPI ex-food and energy) increased +0.1% during the month, and +2.2% in the last 12 months, in line with the previous month’s reading. Although inflation appears to have moderated from the last reading, the underlying trend remains a steady buildup in inflationary pressure (although not runaway inflation), pointing to the Fed continuing on its gradual rate hike path.

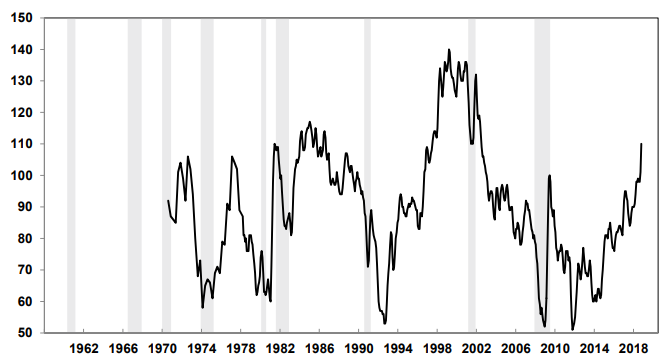

- During the week, we also saw University of Michigan’s consumer sentiment index, which came in below expectations, down 1.1% from the previous month and down 1.7% on an annualized basis. Nonetheless, the index still remains at very favorable levels and is still above the year’s average level. The survey noted that American confidence in U.S. economic policy was at a 15 year high, mainly reflecting an upward adjustment by some Democrats, although still significantly below the more favorable evaluations by Republicans.

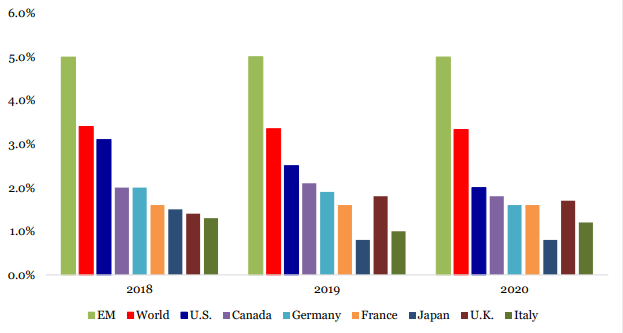

- Global GDP Update: Last week, the International Monetary Fund (IMF) revised its global GDP outlook citing the negative economic impact of trade tensions between the U.S. and trading partners. Global GDP is now expected to grow 3.7%, down 0.2 percentage points from the previous forecast.

Consumer Price Index – All Items YOY % (1982-84 = 100)

Source: Strategas Research Partners, Bureau of Labor Statistics

Confidence in Government Economic Policies

Source: University of Michigan

Real GDP Forecasts (YOY%)

Source: Strategas Research Partners, IMF, OECD

Look Ahead:

- The week will be busy as third quarter earnings season picks up. Notable reporters include Bank of America, Netflix, BlackRock, Johnson and Johnson, United Health, U.S. Bancorp, Philip Morris International, IBM, Procter & Gamble, and Honeywell, among others.

- On the economic calendar, we will see U.S. production and housing data, while abroad we will see ZEW economic sentiment in Europe, trade balance data from Japan, and Chinese Q3 GDP to end the week.