Last Week:

- U.S. equities finished mixed for the week: The Dow Jones Industrial Average (Dow) gained 104 points, or rose 0.41%, to 25,444. The Standard & Poor’s (S&P500) index increased by 1 point, to 2,768. The Nasdaq closed 0.64% lower at 7,449, while the 10-year Treasury ended the week at 3.21%.

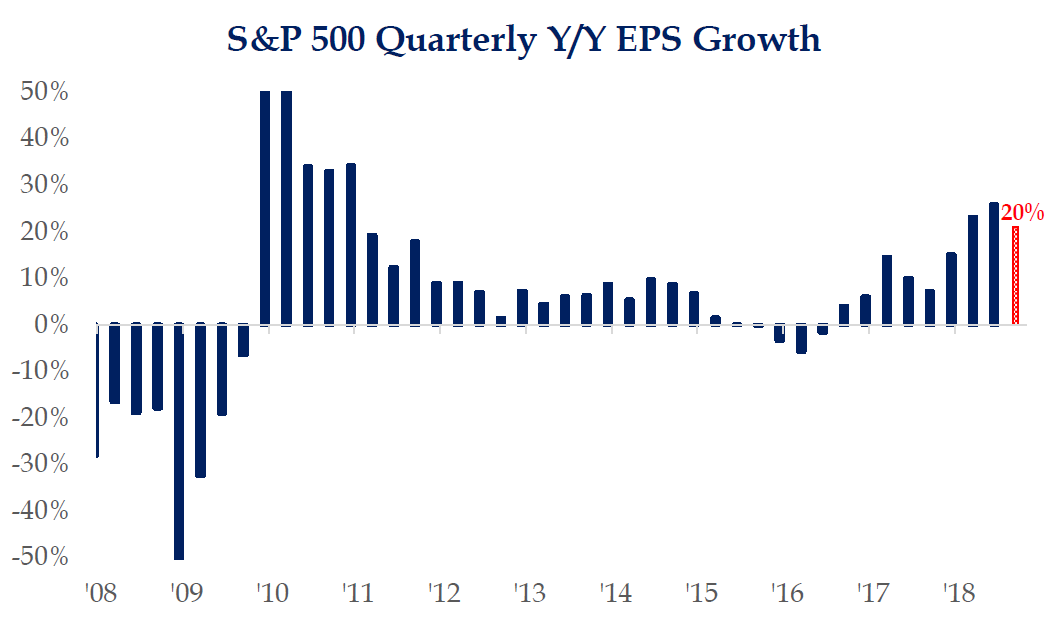

- Third Quarter Earnings Season: According to Bloomberg, out of the 85 S&P500 companies that have reported earnings so far, 86% beat EPS estimates by an average of 4.3%, while 65% came in ahead of topline expectations. Industrial earnings will be in focus in the coming weeks, as investors look to management commentary for insight around the global economic environment and various end markets. At this time, analyst expectations are for 19.5% earnings growth, which would mark the third highest growth rate since the first quarter of 2011.

- Economic Data Recap: Last week, China reported real GDP slowed to +6.5% growth during the third quarter, which—although it remains very strong and in line with expectations—continues to show a slowdown. In addition, although China’s retail sales came in above expectations and inflation numbers were largely in line, Industrial Production for September came in below expectations. Meanwhile U.S. economic data continues to be very strong with retail sales, industrial production, manufacturing production, and JOLTS (Job Openings and Labor Turnover) data all topping expectations last week, except housing linked numbers.

Source: Strategas Research Partners, FactSet Research Systems

Look Ahead:

- The week will be busy as third quarter earnings season continues. Notable reporters include Kimberly-Clark, United Technologies, Verizon, United Parcel Service, Merck, Boeing, O’Reilly Automotive, Microsoft, Altria, Anheuser-Busch Inbev, Comcast, Sherwin-Williams, Union Pacific, Alphabet, and Intel Corp, among others.

- On the economic calendar, we will see Chicago Fed numbers on Monday, Purchasing Managers Index (PMIs) and Home data on Wednesday, and GDP on Friday. Outside the U.S., we will see PMIs in Germany and Euro-zone during the week, and on Friday, the European Central Bank will hold its rate decision meeting.