Last Week:

- U.S. equities continued to fall last week as investors reacted sharply to underwhelming earnings reports and forward outlooks from a few companies. However, on paper, this earnings season continues to be very strong; with expectations for above 20% earnings growth, with 82% of companies beating EPS estimates by an average of 6.2% so far. On the week, the Dow Jones Industrial Average (Dow) lost 756 points, or fell 2.97%, to 24,688. The Standard & Poor’s (S&P500) index decreased 109 points, to 2,659. The Nasdaq closed 3.78% lower at 7,167, while the 10-year Treasury ended the week at 3.09%.

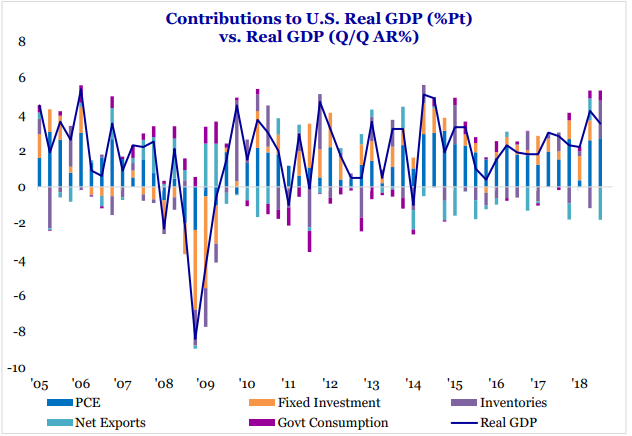

- In spite of the turmoil in financial markets, the U.S. economy remains very strong. According to the Commerce Department, U.S. real Gross Domestic Product (GDP) grew by +3.5% in the third quarter, marking yet another solid quarter, although slightly slower than last quarter’s +4.2% growth. The main drivers of the strong GDP growth number were robust consumer spending (added +2.7% points) and government spending (added +0.6% points). Consumer spending, which accounts for two thirds of U.S. economic activity, grew by +4% during the quarter, substantially up from the +2.6% pace during the preceding four quarters. Meanwhile, the deceleration from the previous quarter reflected a downturn in exports and a deceleration in nonresidential fixed investments. These movements were partially offset by an upturn in private inventory investment.

Source: Strategas Research Partners, U.S. Bureau of Economic Analysis

Look Ahead:

- The week will be busy as third quarter earnings season continues. Notable reporters include American Tower Corp, Coca-Cola, Tapestry, Mastercard, Eaton, Automatic Data Processing (ADP), Baxter, DowDuPont, Apple, Starbucks, Exxon Mobil, and Chevron, among others.

- On the macro calendar, we will see U.S. Personal Consumption Expenditures (PCE) for September, the Q3 Employment Cost Index, U.S. Manufacturing ISM, Auto Sales for October, and the October Jobs Report. Outside the U.S., we will see Eurozone GDP numbers for Q3, as well as October Consumer Price Index (CPI) and China’s October Purchasing Managers Index (PMIs).