Market Commentary: Talking to Strangers

The events of this coming Thursday and Friday (10/10 and 10/11) will most likely dictate the narrative, tone, and sentiment for financial markets through the end of the year. If the U.S.-China trade meeting ends in a “truce,” including a curtailing of the tariff hikes scheduled for October 15th and December 15th, it will go a long way towards calming a jittery market. But that is a big “if” and appears to be the consensus expectation. A recent poll of 133 institutional investors completed by Vital Knowledge showed that 86% expect at least a “truce.” Only 14% believe relations between the two sides will break down again. This suggests that stocks may not enjoy much incremental upside on positive news.

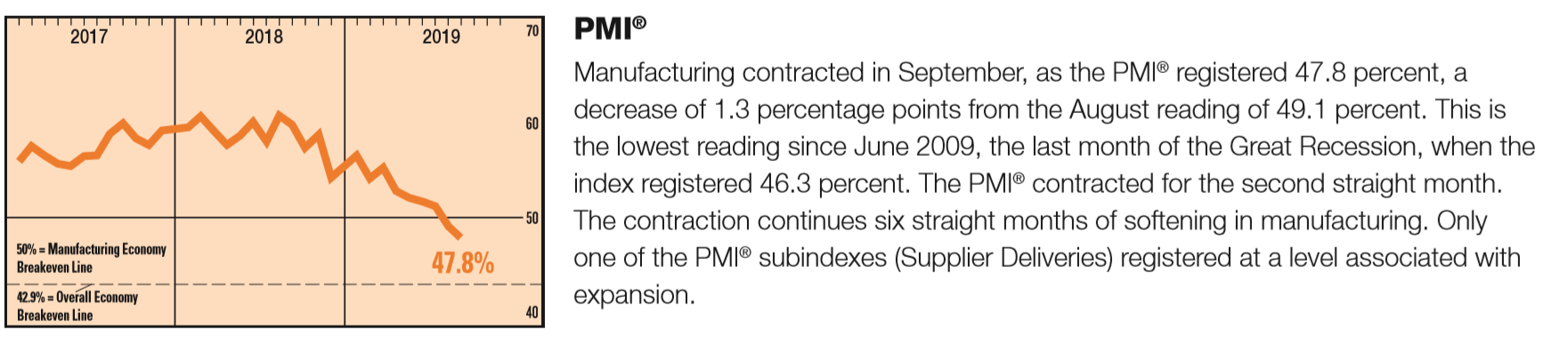

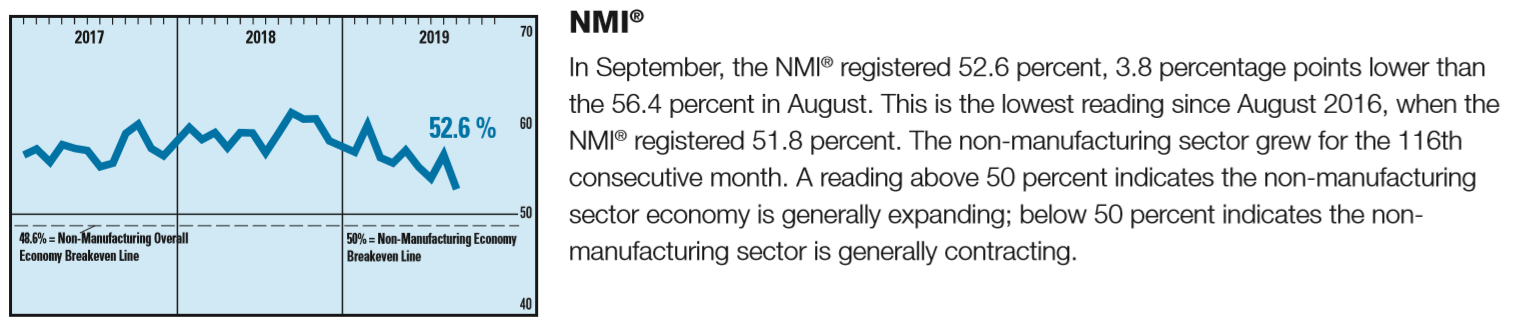

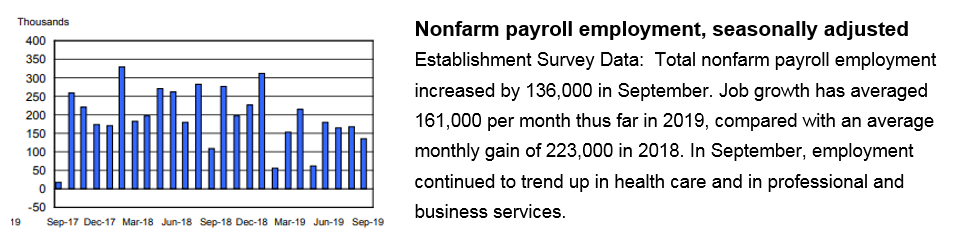

The tariff escalation that would result from a breakdown in negotiations will shine a spotlight on last week’s Institute for Supply Management (ISM) surveys that presaged a softening U.S. economy. For now, as evidenced by last week’s market’s reaction, the Jobs Market is strong enough to keep the consumer healthy, and a healthy consumer is enough to buoy the economy, which is enough for stock investors, even in the face of weak manufacturing data. But more tariffs, which would directly affect the consumer, could force even the optimist to become skeptical of economic growth.

The White House and their proxy negotiators know this. The Chinese also have issues of their own that will hopefully grease the skids for a “mini-deal.” Despite this, there is always the risk of a communication breakdown when dealing with strangers. As Malcom Gladwell states in his new book, Talking to Strangers, success will “require humility and thoughtfulness and a willingness to look beyond the stranger, and take time and place and context into account.” We hope both sides will heed this advice.

Last week’s economic data painted the picture of a growing, but weaker, economy supported by a still healthy consumer with record-low unemployment and continued job gains.