Last Week:

- U.S. equities finished negative for the week: The Dow Jones Industrial Average (Dow) lost 11 points, or fell 0.04%, to 26,447. The Standard & Poor’s (S&P500) index decreased 28 points, to 2,886. The Nasdaq closed 3.21% lower at 7,788, while the 10-year Treasury ended the week at 3.23%, hitting their highest level in seven years.

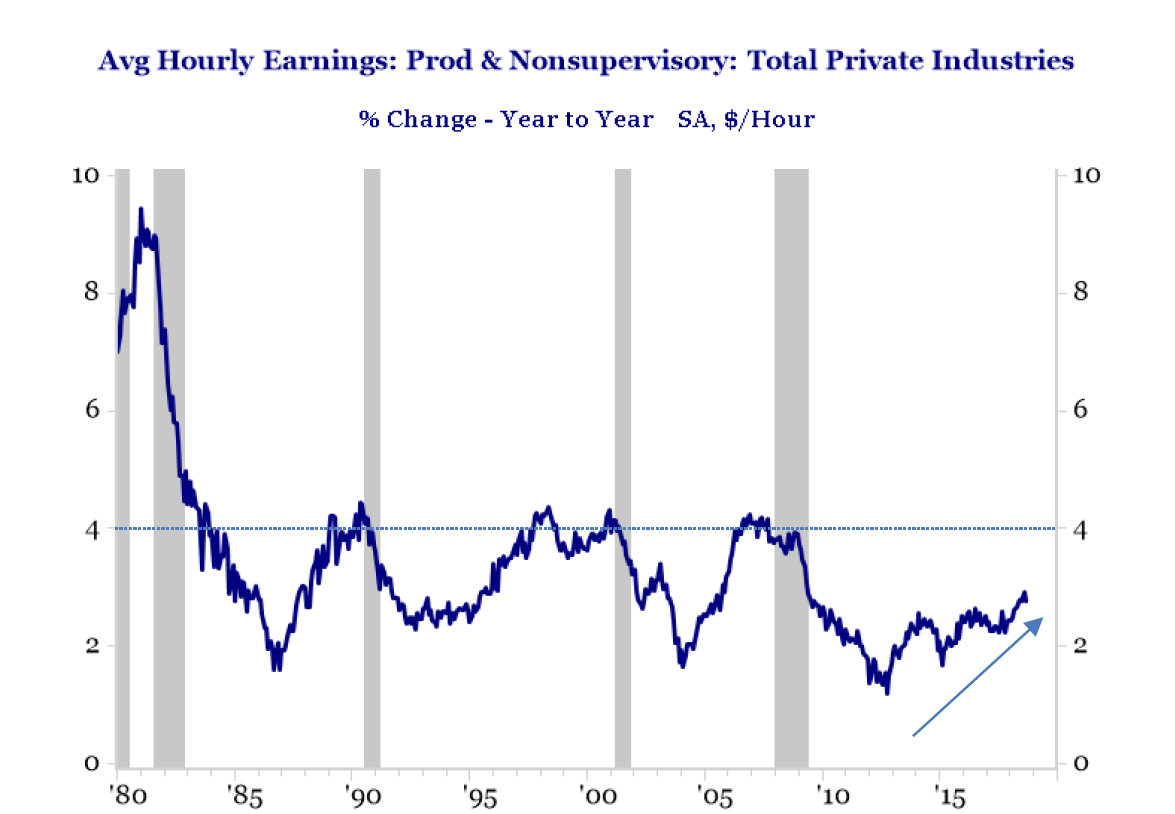

- September Jobs Report: Last week, the Bureau of Labor Statistics reported that the U.S. economy added 134,000 jobs in September, below expectations of 185,000. Although the figure came in significantly below expectations, the number was impacted by Hurricane Florence, which hit the Carolinas earlier in the month. The August jobs number was revised upwards significantly, from 201,000 to 270,000, while July’s numbers went up from 147,000 to 165,000. The unemployment rate dropped to 3.7%, with professional and business services payrolls increasing by 54,000, highlighting the continuing strength of the U.S. labor market. Wage growth came in at 2.8% year over year, right in line with expectations. Overall, the strong jobs report provides support for the Fed to continue on its tightening path, albeit cautiously.

Source: Strategas Research Partners, Bureau of Labor Statistics

Look Ahead:

- The week ahead will start relatively slow on the corporate calendar with bond markets closed today for Columbus Day. However, towards the end of the week, we will see a pickup as large banks begin to release third quarter earnings – a few notable earnings releases during the week include Walgreens Boots Alliance, Fastenal, JP Morgan, Citigroup, PNC, and Wells Fargo, among others.

- On the economic calendar, we will see U.S. Consumer Price Index (CPI) and Producer Price Index (PPI) numbers out mid-week, with Import / Export trade data on Friday. Outside the U.S., we will see China FX reserves on Monday, German Trade numbers out Tuesday, and Chinese Trade balance out Friday.