Last Week:

- U.S. equities finished negative for the week: The Dow Jones Industrial Average (Dow) lost 48 points, or fell 0.2%, to 25,917. The Standard & Poor’s (S&P500) index decreased 30 points, to 2,872. The Nasdaq closed 2.5% lower at 7,903, while the 10-year Treasury ended the week at 2.94%.

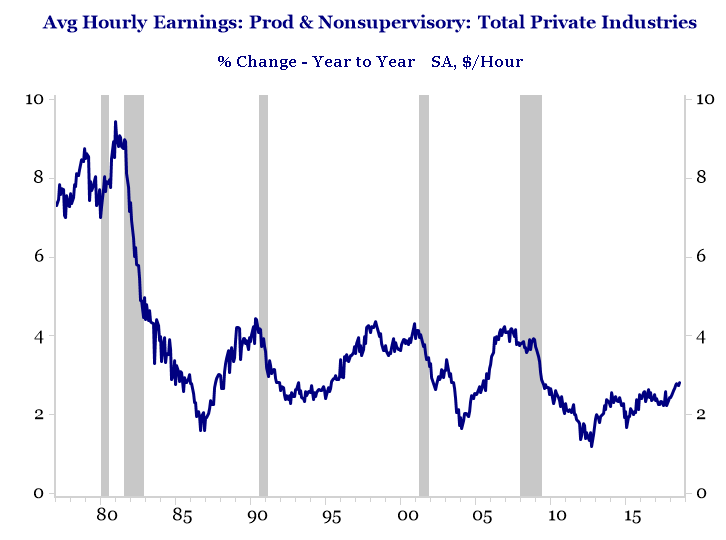

- Another Strong Job’s Report: On Friday, the Labor Department reported nonfarm payrolls rose a seasonally adjusted 201,000 in August, above expectations of 190,000. The unemployment rate remained at 3.9%, in line with expectations, as labor force participation fell slightly to 62.7%. The big surprise was on the wage front where we saw average hourly earnings up +0.4% during the month and +2.9% y/y, marking the highest wage growth since April 2009. The U-6, which measures underemployment, also ticked down to 7.4%. The Fed is still widely expected to raise rates at the September meeting, with more investor focus around changes in Powell’s policy language.

Source: Strategas Research Partners, Bureau of Labor Statistics

Look Ahead:

- Second quarter earnings will continue to wind down this week, with earnings releases expected from Casey’s General Stores, Kroger, Adobe Systems, and Dave & Buster’s among others. During the week, there will be a number of brokerage conferences and analyst meetings.

- On the economic calendar, we will see U.S. Consumer Credit data and Job Openings & Labor Turnover Report (JOLTS) to start the week, with Producer Price Index data on Wednesday, and Import / Export prices data on Friday. Outside the U.S., we will see China Consumer Price Index data and Producer Price Index data on Monday, interest rate decision from the European Central Bank and Bank of England on Thursday, and Chinese Industrial Production data on Friday.