Last Week:

- U.S. equities finished positive for the week: The Dow Jones Industrial Average (Dow) gained 238 points, or rose 0.9%, to 26,155. The Standard & Poor’s (S&P500) index increased 33 points, to 2,905. The Nasdaq closed 1.4% higher at 8,010, while the 10-year Treasury ended the week at 2.99%.

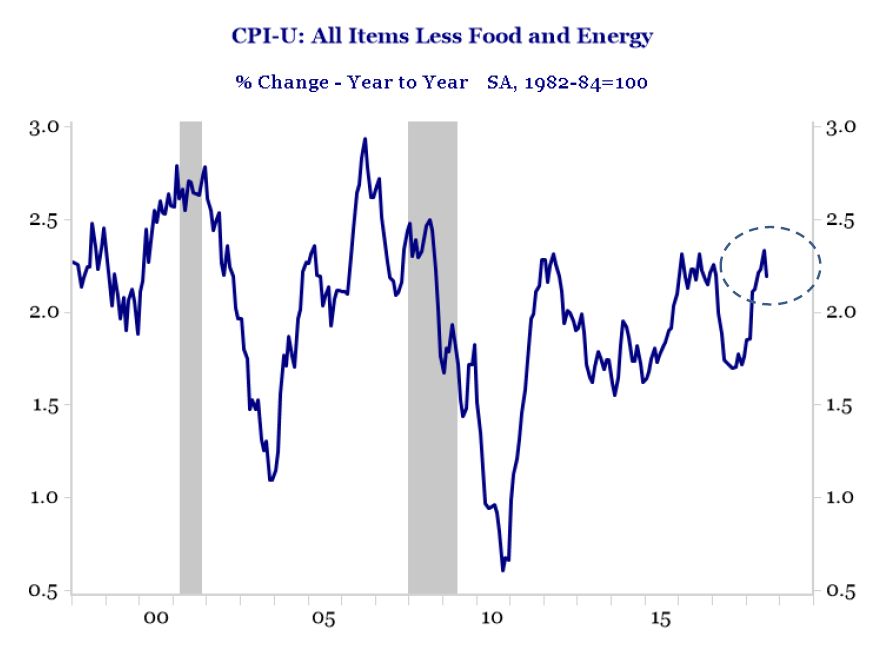

- U.S. Inflation: Last week, The Bureau of Labor Statistics reported U.S. inflation as measured by the Consumer Price Index (CPI) increased +0.2% in August and +2.7% year over year. Core CPI (CPI ex food and energy) increased +0.1% during the month and +2.2% in the last 12 months, a slight deceleration. Although inflation appears to have moderated from the last reading, the underlying trend remains a steady buildup in inflationary pressure (although not runaway inflation), pointing to the Fed continuing on its gradual rate hike path. Although the Fed’s formal guidance is calling for two rate hikes for the remainder of 2018, investor expectations are for one hike at the September meeting and more than a 70% chance of a hike in December.

Source: Strategas Research Partners, Bureau of Labor Statistics

Look Ahead:

- The week ahead will be relatively slow on the corporate calendar with a few earnings releases including, FedEx, Oracle Corp, General Mills, and AutoZone, Inc. among others.

- On the economic calendar, we will see U.S. Empire manufacturing numbers on Monday, followed by NAHB housing index on Tuesday, and Markit Purchasing Managers Index (PMI) to end the week. Outside the U.S., we will see Euro-zone CPI on Monday, Euro-zone current accounts and consumer confidence later in the week, with Flash PMI closing the week. In Japan, we will have Import / Export prices on Tuesday night and the Bank of Japan rate decision on Wednesday, closing the week with CPI on Thursday.