Last Week:

- U.S. equities finished positive for the week: The Dow Jones Industrial Average (Dow) gained 589 points, or rose 2.25%, to 26,743. The Standard & Poor’s (S&P500) index increased 25 points, to 2,930. The Nasdaq closed 0.2% lower at 7,987, while the 10-year Treasury ended the week at 3.07%.

- China/U.S. Trade: The U.S. (10% on $200B worth of goods vs the 25% on $200B originally envisioned) and China’s (5-10% on $60B worth of goods vs the 5-25% on $60B originally envisioned) tariffs will go into effect today, September 24th. Meanwhile, the trade talks originally scheduled for this week between Washington and Beijing have been called off.

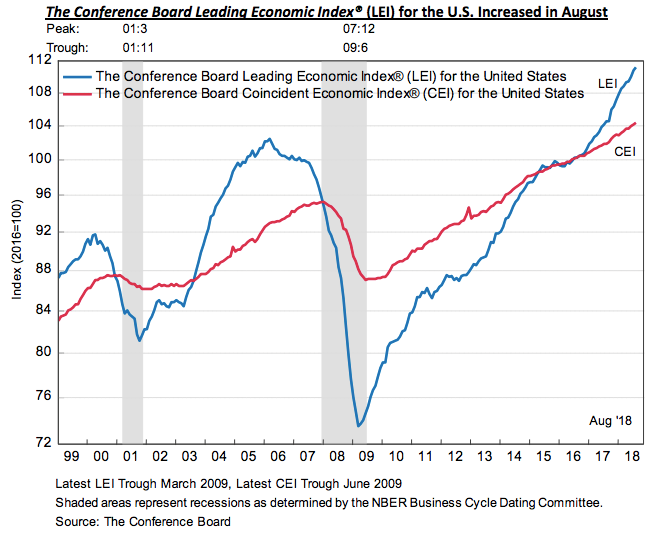

- U.S. Leading Economic Indicators (LEI): The Conference Board’s Leading Economic Indicators Index for the U.S. rose 0.4% during the month of August, following the 0.7% increase in July and June’s 0.5% increase. Although the August numbers appear modest relative to the strong numbers we’ve seen this year, they are consistent with the narrative of a strong U.S. economy at this stage of a maturing business cycle. According to the Conference Board, although industrial companies that are more sensitive to the business cycle can expect a moderation in 2019, the widespread strength in the LEI components supports the outlook of above 3% growth for the second half of the year. The Board’s Coincident Economic Index (CEI), a measure of current economic activity, increased 0.2%, with the Lagging Economic Index also increasing 0.2% during the month.

Look Ahead:

- The week ahead will be relatively busy with news flow. On the corporate calendar, we will see some notable earnings releases from FactSet Research Systems, Nike, Conagra Brands, CarMax, and Accenture Plc., among others. In addition, there will be a number of analyst meetings and conferences during the week.

- On the economic calendar, we will see U.S. macro data including Chicago and Dallas Fed activity and the S&P case Shiller home price index. Mid-week we will see a Federal Open Market Committee (FOMC) interest rate decision and Q2 final GDP. On Wednesday, investors fully expect a rate hike decision and the focus will be on Powell’s language. Towards the end of the week, we will also see personal income and spending reports for August. Outside the U.S., we will see Euro-zone consumer confidence numbers and the European Central Bank economic bulletin, as well as Consumer Price Index later in the week.