Impeachment: Market Risk or Political Theater?

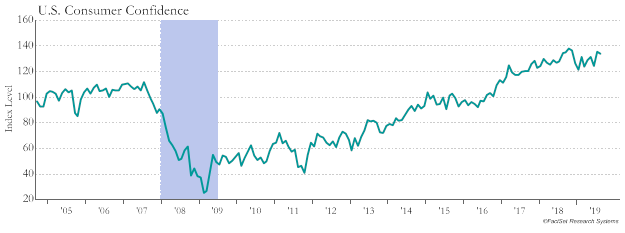

Political theater. What really matters to this market is Trade and the Consumer. On September 24, the Conference Board Consumer Confidence Index dropped to 125.1, down from August’s reading and down close to 8% from a year ago. Confidence readings have been volatile for almost a year now. However, wallets speak louder than words and consumer spending appears to remain strong. Our analysis of 15 years of consumer confidence data shows that when confidence declines year-over-year by up to 10%, consumers continue to increase retail spending by 3.5% during the subsequent 12 months. On average, during the past 15 years, retail sales have grown close to 4% per annum. We expect retail sales growth may slow somewhat, but will remain robust enough to support the economy.

Housing data released last week exceeded expectations. August New Home sales jumped 7.1% month over month at a median sales price of $328,400. The Pending Homes sales index increased 1.6% in August, exceeding expectations for a 1.0% monthly advance. Housing represents a small percentage of GDP, but we believe it is a sector that “punches well above its weight.” Housing is an example of the Federal Open Market Committee’s quick action to reduce interest rates in the face of a slowing economy paying off. According to Freddie Mac, the 30-year fixed rate average fell to 3.64% last week, a 30-year mortgage cost an average of 4.72% a year ago.

Despite consumer strength, the U.S./China trade negotiation remains the key to this market. A breakthrough on trade could lead the markets to new highs in very short order, but a further ratcheting up in tensions will pose yet another headwind. This brings us back to the question of impeachment. Unfortunately, impeachment proceedings will imperil any chance of the USMCA (new NAFTA) being passed by Congress. Only last week, Nancy Pelosi voiced her desire to bring a vote on the legislation to the floor of the House. It is hard to envision that happening now. This could possibly lead President Trump to threaten unilateral action on NAFTA. If proceedings pick up steam, we can also envision Trump escalating the dispute with China in an effort to reshape the narrative. Lastly, Elizabeth Warren appears to be the clear winner last week, and her poll numbers are rising. We don’t let politics get in the way of investing, but Warren does pose more uncertainty to the business community than either Trump or Biden.