Three Trends Shaping the Bull Market

Tim Hoyle, Chief Investment Officer

thoyle@haverfordquality.com

During the third quarter of 2025, the S&P 500 rose nearly 8%, recorded 24 all-time high closes, and was never down more than 2%. Heading into the final quarter of the year we anticipate three major trends from the third quarter will continue to power the market’s steady ascension.

- Easing monetary policy

- Strong earnings growth

- AI optimism, with some moderation

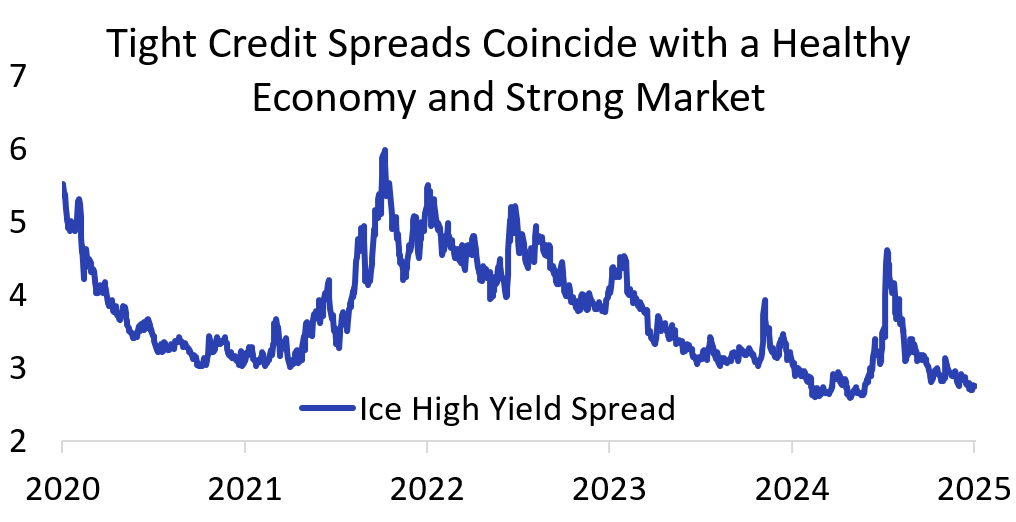

Easing monetary policy. Historically, markets react very well to rate cuts when the economy is growing and markets are near all-time highs. Tight credit spreads, wage growth, strong corporate profits, and low unemployment are all consistent with a low probability of a near-term recession, which makes monetary easing especially bullish. The tailwind of easier monetary policy may also be supercharged by recent corporate tax cuts and extension of the personal tax code.

Tight Credit Spreads Coincide with a Healthy Economy and Strong Market

Source: Haverford

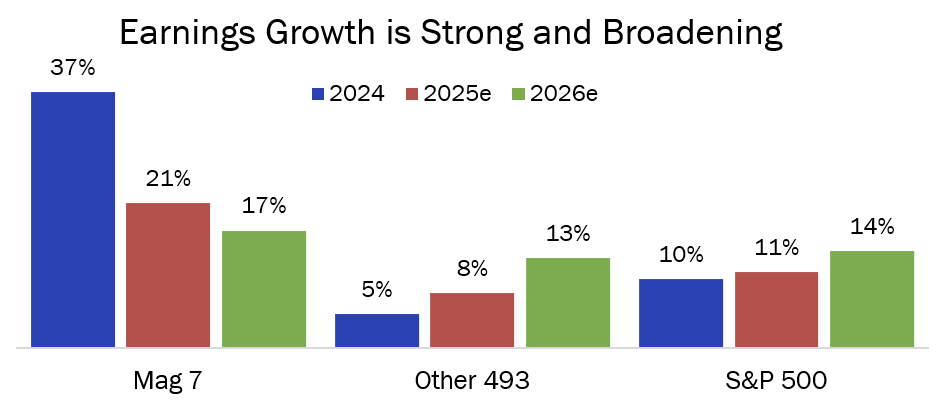

Strong earnings growth. Following last year’s 10% increase in corporate profits, earnings are projected to grow 11% in 2025 and 14% in 2026. The broadening out of earnings growth to include companies beyond the tech-heavy Magnificent 7 stocks also is a positive development for the markets. Broad earnings growth is indicative of a stronger economy and potentially more resilient markets.

Earnings Growth is Strong and Broadening

Source: Haverford

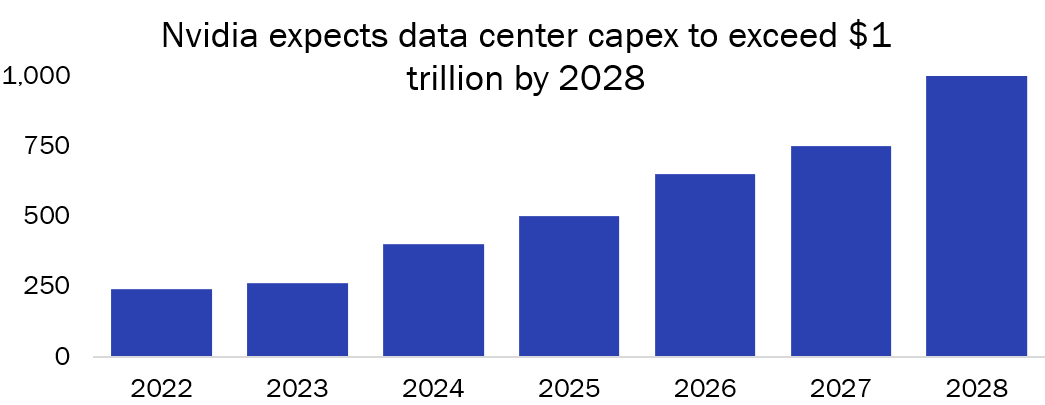

AI optimism. The pace of AI infrastructure spending continues to accelerate as AI permeates all aspects of our lives. Tech giants are in an arms race to provide the computing power needed to meet expected demand. Lofty expectations and the amount of capital being deployed raises concerns of a bubble. We believe advancements in AI will eventually enable the tools to accelerate economic growth. However, thus far, tangible and widespread gains have been slow to materialize.

Nvidia Expects Data Center Capex to Exceed $1 Trillion by 2028

Source: Nvidia

The AI trade may have gone too far, too fast, and could be due for a pause. While we have seen tremendous profits and stock appreciation accrue to the semiconductor manufacturers and hyperscalers, much of the rest of the economy has yet to materially benefit. We believe industries such as software, services, healthcare, and consulting will begin to benefit as AI is incorporated into the business processes.

While the ingredients exist for the bull market to continue, there is always the possibility that optimism sours and investors look to lock in this year’s gains. Low consumer sentiment, weaker employment data, or even political exhaustion could tip the scales. Investors should consider taking advantage of the strong markets to work with their portfolio managers to optimize asset allocations and planning.

Media Inquiries

Veronica Mckee, CMP

Direct Phone: 610.995.8758

Email: vmckee@haverfordquality.com

Katie Karsh

Direct Phone: 610.755.8682

Email: katie@gobraithwaite.com

Disclosure

These comments are provided as a general market overview and should not be relied upon as a forecast, research or investment advice, and is not a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. Opinions expressed are as of the date noted and may change at any time. The information and opinions are derived from proprietary and non-proprietary sources deemed by Haverford to be reliable, but are not necessarily all-inclusive and are not guaranteed as to accuracy. Index returns are presented for informational purposes only. Indices are unmanaged, do not incur fees or expenses, and cannot be invested in directly.

Investments in Securities are Not FDIC Insured · Not Bank Guaranteed · May Lose Value