Below is the fourth installment of a series on the past decade and potential implications for investors in the future. Click here to read the previous installment. For additional in-depth analysis of current economic and financial issues, please visit Haverford News & Insights.

Tim Hoyle, Co-Chief Investment Officer

thoyle@haverfordquality.com

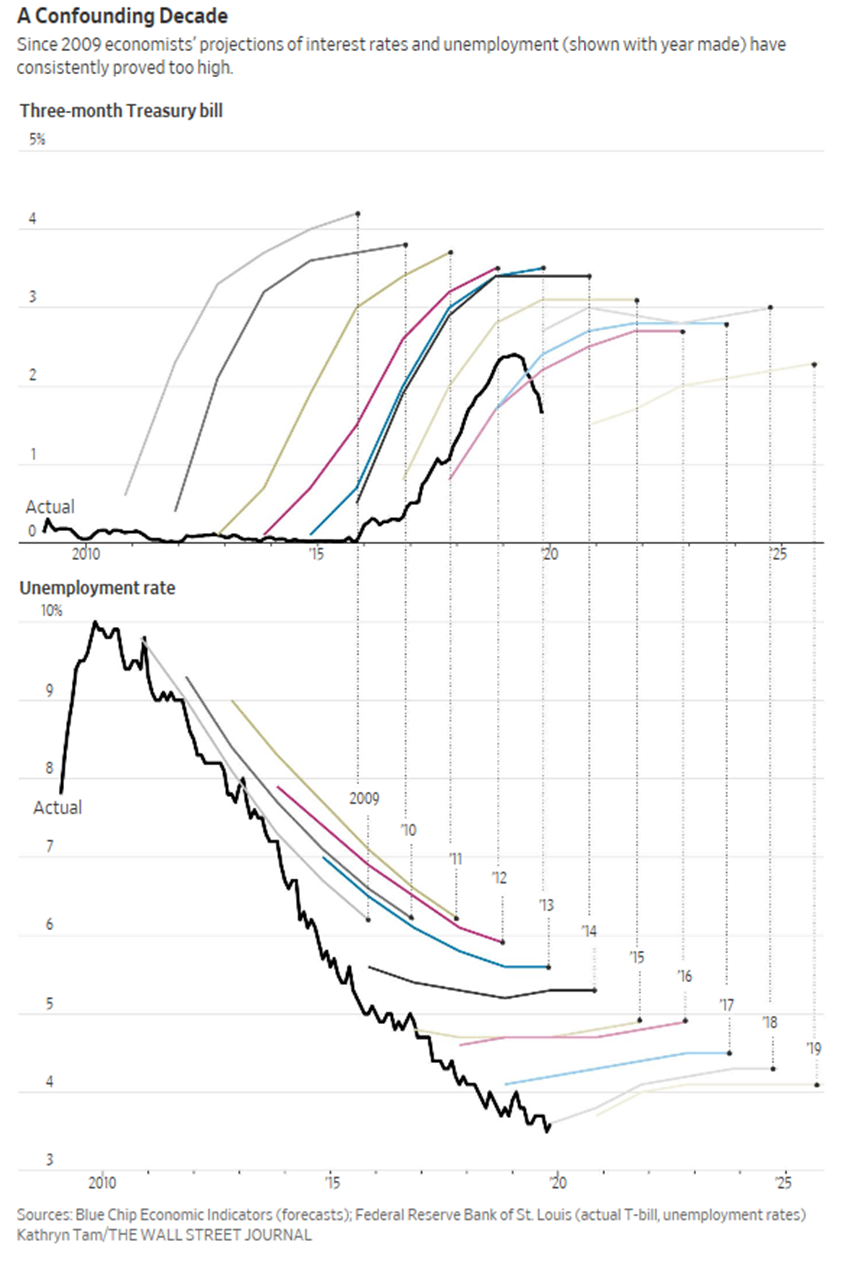

More often than not over the last decade, expert guesses on inflation, interest rates, employment, stock returns, elections, economic expansions, debt, and deficits have proven wildly off the mark. During this time, many predictive models have proven almost entirely un-predictive. Economic, market, and political forecasting has always been difficult, but since the Great Recession of 2008 it has proven to be exceptionally futile.

For years, many economic scholars and soothsayers have been dubious of the U.S. economic expansion and the bull market in stocks. Early on, Carmen Reinhart and Kenneth Rogoffi were the star witnesses in a drama that was “economists v. economy.” Their popular prediction was that too much debt would crowd out the private sector and lead to another crisis, and it proved to be incorrect. Then came others’ inaccurate forecasts for negligible economic growth and persistent, high unemployment.

When in 2012, the Federal Reserve started using unconventional methods such as Quantitative Easing to stave off deflation, many thought it was foolish and only a matter of time until inflation ran out of control. When rampant inflation did not occur, forecasts then pointed to employment trends that would increase inflationary pressures. The unemployment rate peaked near 10% and has since fallen to 3.5% amidst increased labor participation – yet still no inflation.

The lack of inflationary pressures despite tight labor markets has profound implications. It is evidence that what economists call the natural rate of unemployment (the lowest rate sustainable without stoking inflation) is actually well below the 5% number generally referred to in textbooks. If the relationship between full employment and higher inflation—known as the Phillips Curve—no longer exists, it means that one of the basic tenets of economics is broken.

Just because the models may be broken and many economists have gotten forecasts wrong for a decade, doesn’t mean investors should start ignoring the profession. We just need to guard against giving too much significance to forecasts and opinions, no matter how erudite the messenger.

Every article, news cast, or blog post you consume will likely contain a prediction or propel you, the reader, to make a prediction of your own. Every time we actively listen to another’s opinion, we are likely forming a prediction ourselves. Below are six steps to remember as both consumers and formulators of forecasts.

Economics is an art, not a science. John Maynard Keynes said, “Economics is a method rather than a doctrine, an apparatus of the mind, a technique of thinking which helps its possessor draw correct conclusions.” Remember economics is just a framework that helps us describe human nature. It is very difficult to predict behavior, sentiment, and rationality.

Forecasters are often ideological. Just like all of us, economists tend to align with one of a variety of intellectual traditions. Given that economics and politics are often intertwined, an economist’s work may be clouded by their preference for specific policies. Always look for an underlying bias that may influence one’s prediction. Also, remember that many forecasts—even from an academic—are made for marketing purposes.

Beware specificity. One would rather be approximately right, than precisely wrong. As true as this statement is, specific predictions still attract attention and can propel people into action. Don’t get caught up on specific forecasts that will likely be precisely wrong.

Instead, focus on the probabilities. Any good forecast will provide a range and probabilities of possibilities. A 25% chance of recession implies a 75% probability for growth. Thinking about all possible outcomes will allow you to utilize forecasts.

Beware of forecasters drawing straight lines. We all suffer from what is called Recency bias, i.e. extrapolating the recent past into the future. Beware of any prediction that relies only on a recent and limited number of data points.

Focus on the process. Instead of focusing on the outcome, investigate the process to derive a prediction or economic forecast. Shifting your analysis from outcome-based to process-based will make you wiser.

Investors can unintentionally shift their portfolio towards dubious predictions. Instead, always maintain a long-term approach and proper diversification. Investing would be easy if economists could accurately predict the future, but they can’t.

Remember that everyone is bad at forecasting. It is overwhelmingly obvious that the Sturgeon Law applies. This is a forecast any economist can make.