Tim Hoyle, Chief Investment Officer

Thoyle@haverfordquality.com

Earnings Results Justify Lofty Multiples for Top Tech Companies

As of October 31st, 64% of S&P 500 companies, representing the vast majority of the market capitalization of the index, have reported earnings. Of those companies, 80% surprised on earnings growth while 79% outperformed revenue expectations. Overall, 3rd quarter earnings growth is tracking at 10.7%, marking the 4th straight quarter of double-digit, year-over-year growth. ¹2025 earnings are projected to grow 11.5% with 2026 growth close to 14%. If earnings are realized, it will mark 3 straight years of double-digit growth, a winning streak not seen since the early 2000's.

¹Factset Earnings Insights

Picture1

Source: The Haverford Trust Company

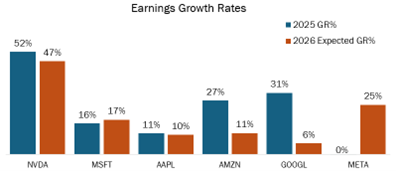

Last week's earnings reports from many of the largest U.S. tech companies highlighted the demand for AI-related services, reinforced their dominant position in the market, and validate their premium valuations. Microsoft delivered strong results with revenue growth driven by its cloud and AI segments, while Apple beat expectations on strong services revenue with iPhone revenue increasing double digits. Meta posted impressive advertising revenue growth and highlighted its expanding AI capabilities and Google parent Alphabet announced their Cloud Platform (GCP) is thriving due to growing demand for cloud products and services.

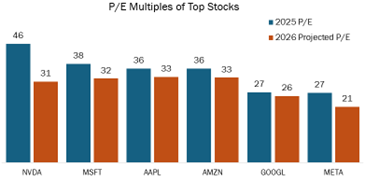

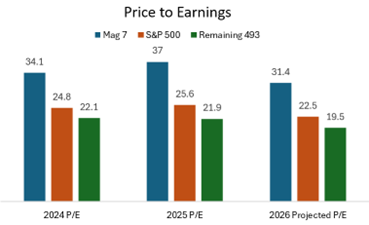

These large U.S. tech companies and others affiliated with the roll out of AI infrastructure and services, trade at relatively high price-to-earnings ratios. Microsoft, Apple, Nvidia, and Amazon all trade around 32x expected 2026 earnings, while Alphabet trades at 26x. Meta trades cheapest of the group, priced at only 21x earnings, based on investors' concerns that the company's spending spree will not yield a suitable return on investment. While these valuations are elevated relative to historical averages, they are a reflection of the corporations' quality, scale, innovation, and leadership. We believe their consistent earnings growth, strong balance sheets, and strategic positioning in transformative technologies justifies their premium valuations. Of the Mag 7, only Tesla trades at a cult-like valuation of 212x earnings.

Picture2

Source: The Haverford Trust Company

Picture3

Source: The Haverford Trust Company

Excluding the Mag 7, the rest of the market trades below 20x earnings, yet offers lower expected growth rates. While there a many compelling opportunities outside the top tier, the stock market will likely share the fate of these magnificent corporations. As long as they can sustain robust and resilient earnings growth, investors will likely continue to pay premium valuations.

Picture4

Source: The Haverford Trust Company

Picture5

Source: The Haverford Trust Company

Media Inquiries

Veronica Mckee, CMP

Direct Phone: 610.995.8758

Email: vmckee@haverfordquality.com

Katie Karsh

Direct Phone: 610.755.8682

Email: katie@gobraithwaite.com

Disclosure

These comments are provided as a general market overview and should not be relied upon as a forecast, research or investment advice, and is not a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. Opinions expressed are as of the date noted and may change at any time. The information and opinions are derived from proprietary and non-proprietary sources deemed by Haverford to be reliable, but are not necessarily all-inclusive and are not guaranteed as to accuracy. Index returns are presented for informational purposes only. Indices are unmanaged, do not incur fees or expenses, and cannot be invested in directly.

Investments in Securities are Not FDIC Insured · Not Bank Guaranteed · May Lose Value